About Reservoir

Reservoir is a cutting-edge decentralized finance (DeFi) platform focused on creating the most scalable and resilient stablecoin protocol in the blockchain ecosystem. Its mission is to build a reliable and efficient infrastructure for stablecoin issuance that supports a wide array of digital and real-world assets. With the ever-increasing demand for permissionless, secure, and high-yield alternatives in the crypto economy, Reservoir positions itself as a next-generation protocol that addresses the limitations of current stablecoin models.

The platform introduces a suite of products, including rUSD (a next-gen stablecoin), srUSD (a liquid yield-bearing asset), and trUSD (a term-based yield product), backed by a diversified collateral structure. By being permissionless and deploying across Ethereum and top-tier networks, Reservoir offers an accessible and scalable foundation for capital-efficient DeFi ecosystems.

Reservoir is a next-generation stablecoin protocol designed to be both scalable and trustworthy. Built on Ethereum with integrations across high-performance chains, the project provides users with a diverse range of stablecoin solutions to meet varying liquidity and yield preferences. The core of the system lies in its multi-asset collateral support and modular architecture, enabling real-time issuance, yield generation, and borrowing functionalities. Through this design, Reservoir ensures accessibility, stability, and capital efficiency across all market conditions.

At its foundation, Reservoir aims to solve a critical challenge in DeFi: the overreliance on single-asset or overly volatile collateral for stablecoins. Instead, it introduces a model that incorporates both on-chain digital assets and off-chain real world assets (RWAs). This hybrid model not only diversifies risk but also enhances scalability, allowing the protocol to support a much larger volume of stablecoins. The primary tokens offered by the protocol include:

- rUSD: A decentralized, fully-backed stablecoin with real-time liquidity.

- srUSD: A yield-bearing liquid version of rUSD, ideal for passive income strategies.

- trUSD: A term-based yield product offering fixed returns over defined periods.

Unlike traditional protocols that are often restricted by centralization or collateral limits, Reservoir is permissionless and accessible globally. Its open architecture also enables the creation of decentralized lending markets using these stable assets. Whether in bull or bear markets, Reservoir aims to deliver superior yields, leveraging higher-quality, lower-volatility, and more diversified collateral than other protocols. By doing so, it mitigates systemic risk while optimizing returns for users.

In terms of positioning, Reservoir competes with projects like Frax, and Overnight. While these platforms also focus on decentralized stablecoins and yield strategies, Reservoir's integration of both digital and real-world assets, alongside multiple yield-bearing products, gives it a unique edge in terms of scalability and collateral diversity.

Reservoir provides numerous benefits and features that make it a standout protocol in the stablecoin ecosystem:

- Multi-Collateral Support: Reservoir backs its stablecoins with a diverse range of digital and real-world assets, enabling higher scalability and reduced volatility.

- High Yield Opportunities: The platform offers superior yields through srUSD and trUSD, outperforming traditional stablecoin interest models across market cycles.

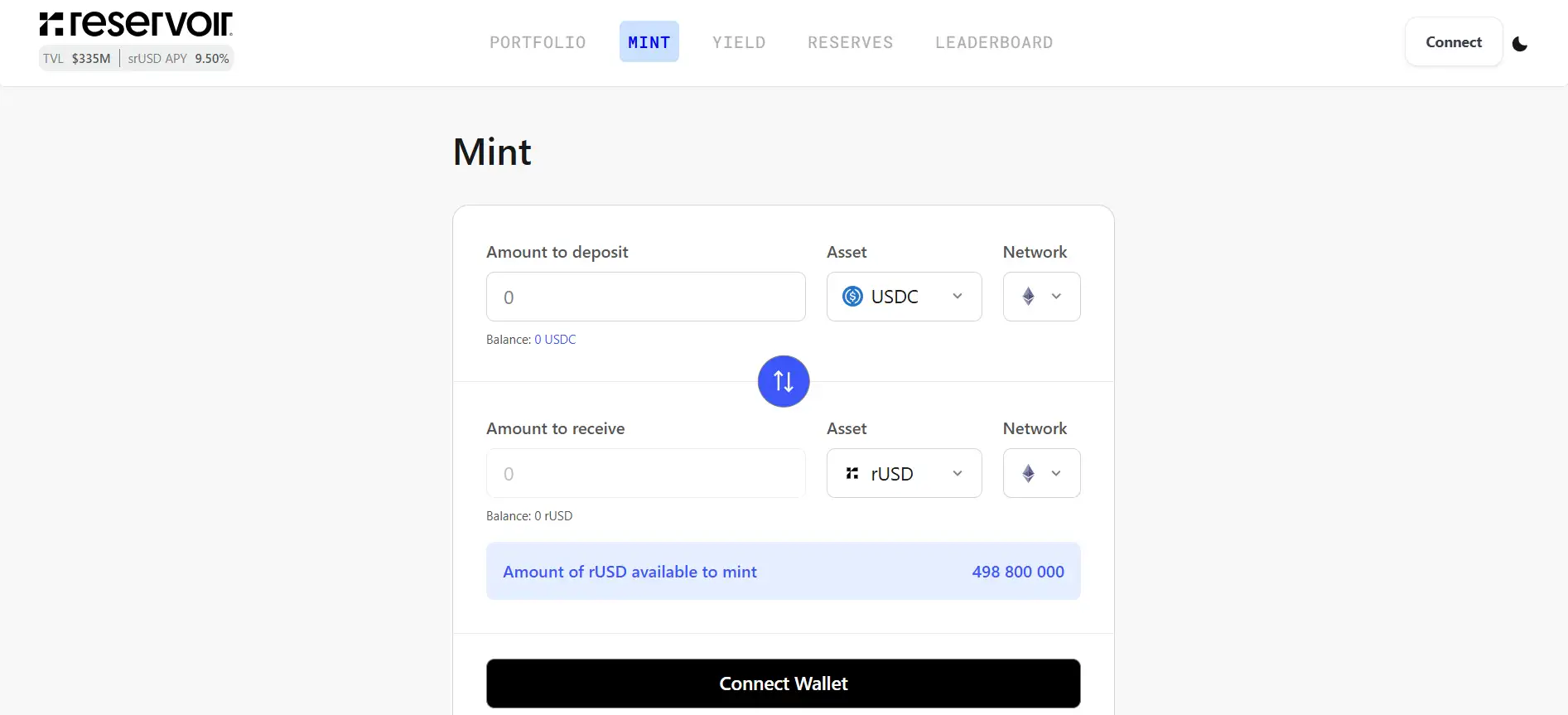

- Instant Liquidity: Users can mint, redeem, and convert stablecoin assets with minimal delay and slippage, supporting a wide range of DeFi applications.

- Permissionless Architecture: Anyone can access the platform without needing approval or centralized control, staying true to decentralization principles.

- Cross-Network Compatibility: Built on Ethereum and integrating with top-tier L2s and sidechains, Reservoir ensures seamless access and high-performance interactions.

- Stable Performance in Any Market: The protocol is designed to function optimally during both bull and bear markets by relying on high-quality assets and diversified exposure.

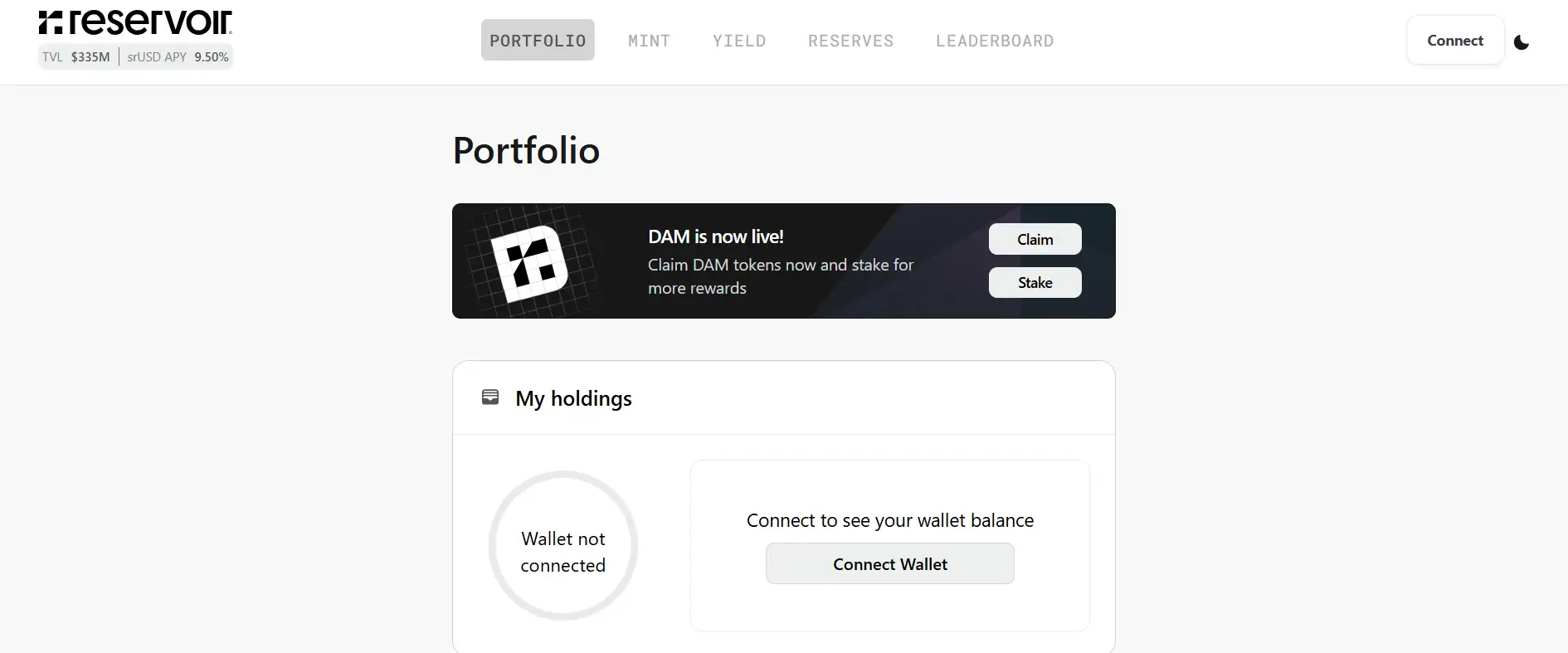

Reservoir makes it easy for users to begin interacting with its suite of stablecoin products and DeFi tools:

- Visit the Platform: Head over to the official website at reservoir.xyz and click on "Launch App" to access the dApp.

- Connect Wallet: Use a supported wallet such as MetaMask or WalletConnect to connect to the Reservoir protocol. Make sure you’re on the Ethereum network.

- Choose a Stablecoin Product: Select from rUSD, srUSD, or trUSD depending on your yield or liquidity needs.

- Mint or Deposit: Supply collateral from supported assets to mint stablecoins or deposit into yield-generating contracts.

- Track Your Yield: Monitor your APY and rewards directly from the dashboard. srUSD offers dynamic yield while trUSD provides fixed returns.

- Stay Updated: Join the official Discord or follow the team on X (Twitter) for real-time updates and community discussions.

Reservoir FAQ

Reservoir incorporates real-world assets (RWAs) into its collateral system through a diversified basket of both on-chain digital assets and off-chain real-world instruments. This means that its stablecoins, like rUSD, are not only backed by cryptocurrencies but also by tokenized real-world assets such as bonds, treasury instruments, or other regulated financial products. By doing so, Reservoir creates a more stable, scalable, and risk-mitigated foundation for its next-generation stablecoin protocol.

rUSD is the core stablecoin issued by Reservoir, fully collateralized and instantly redeemable. srUSD is a liquid yield-bearing asset that allows users to earn ongoing returns while maintaining liquidity, making it ideal for dynamic DeFi strategies. trUSD, on the other hand, is a term-based yield product that offers fixed yields over a specified period for users who prefer predictable returns. This three-tier system enables users to select the exact balance of stability, liquidity, and yield that suits their investment goals.

Reservoir achieves consistent and high yields by leveraging its multi-collateral system and diversified exposure to digital and real-world assets. Unlike traditional stablecoin protocols, it optimizes returns through sophisticated yield strategies, including lending, liquidity provision, and tokenized asset integrations. This diversified approach ensures that users holding srUSD or trUSD can earn superior yields regardless of market conditions, while maintaining stable collateral support. The protocol’s flexibility allows it to reallocate collateral dynamically to the best-performing opportunities.

Yes. Reservoir has built-in support for permissionless lending markets using its stablecoins like rUSD, srUSD, and trUSD. This means that anyone, anywhere can supply or borrow these assets without requiring centralized approval or KYC restrictions. By integrating lending directly into the protocol, Reservoir empowers users to deploy their stablecoins in a fully decentralized manner, earning interest or obtaining liquidity instantly.

Reservoir employs a combination of on-chain transparency, audited smart contracts, and risk management frameworks to secure user funds and collateral. The protocol uses multi-signature governance for key operations and integrates with top-tier oracles to ensure accurate pricing of both digital and real-world assets. Additionally, Reservoir undergoes regular security audits and engages its community in governance decisions to maintain a resilient and trustless ecosystem.

You Might Also Like