About SmartCredit.io

SmartCredit.io is an AI-driven, self-custodial lending platform transforming decentralized finance with fixed-term, fixed-interest-rate loans and personal fixed-income solutions. Through SmartCredit.io, users gain predictable lending and borrowing experiences, access robust staking rewards, and interact securely with a fully decentralized infrastructure that offers unprecedented control over assets.

Positioned as a pioneer in programmable credit and fixed-income DeFi markets, SmartCredit.io empowers users to optimize their capital efficiency with unique tools like leveraged Lido staking and AI-based transaction monitoring. With its commitment to self-custody, risk management, and transparency, SmartCredit.io is reshaping the future of decentralized lending.

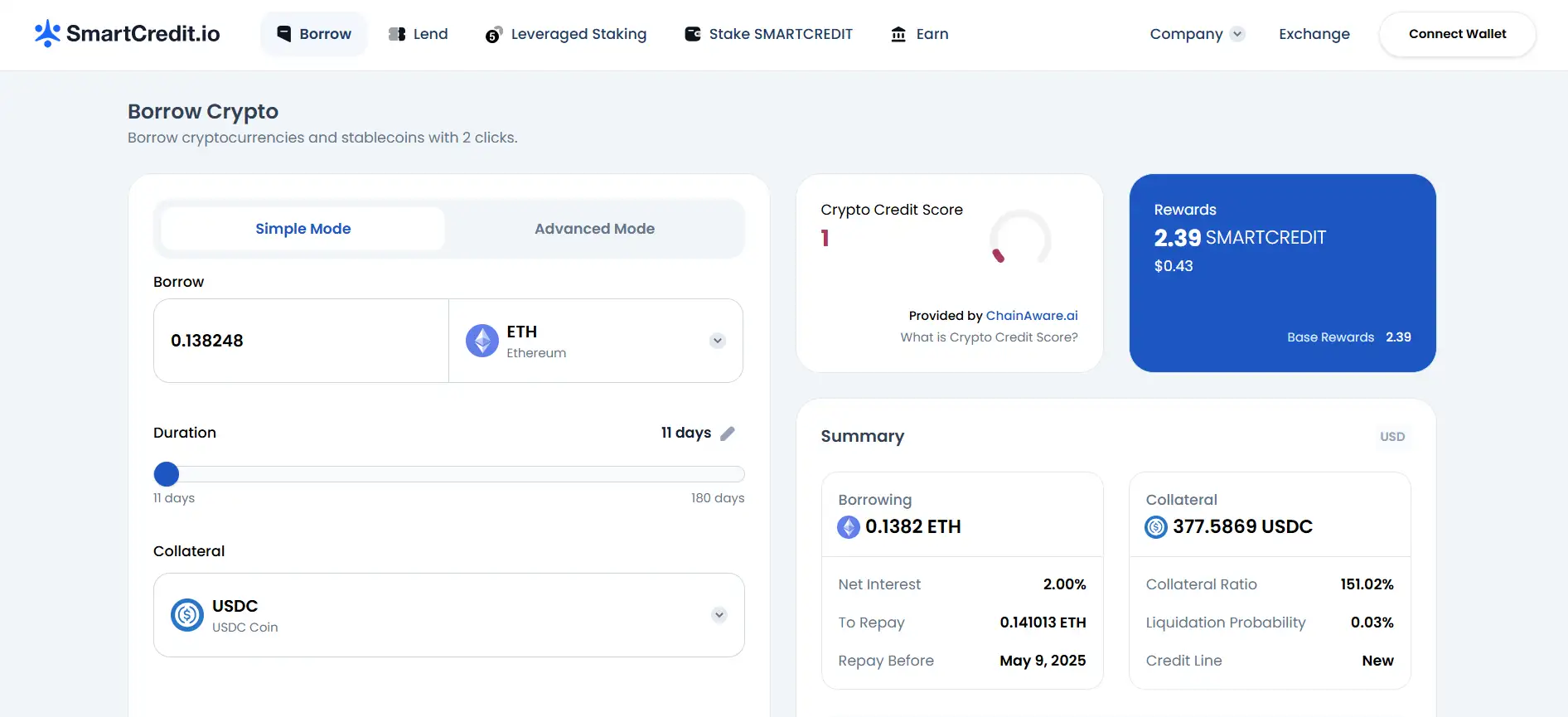

SmartCredit.io operates as a decentralized, non-custodial global lending marketplace that connects lenders and borrowers directly without intermediaries. Focusing on predictability and security, SmartCredit.io offers fixed-term, fixed-interest-rate loans, enabling borrowers to clearly understand their repayment schedules and costs — a unique value proposition in a market dominated by volatile variable-rate loans.

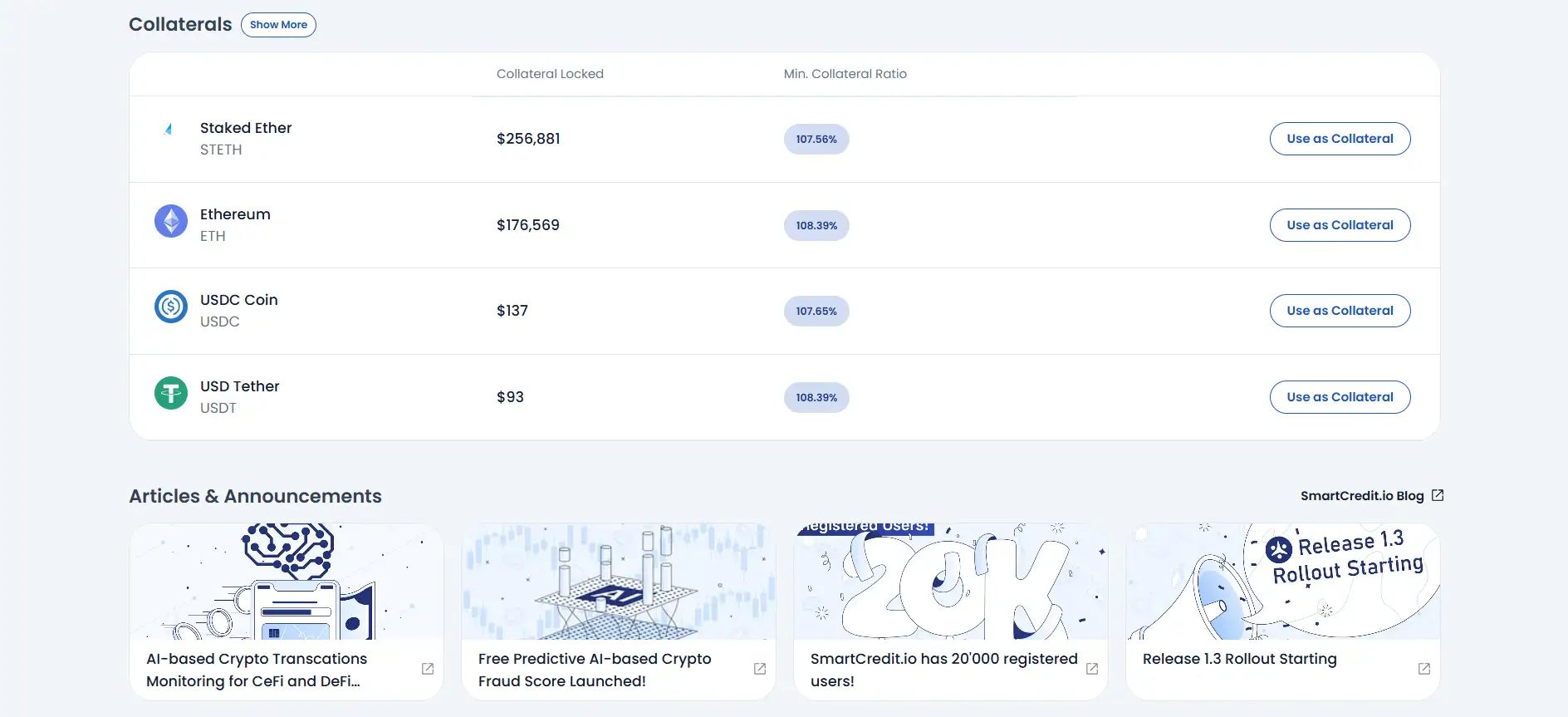

The platform's standout innovation is its Personal Fixed Income Funds, allowing lenders to design custom lending portfolios based on personal strategies, whether short-term low-risk or long-term high-return lending. Additionally, SmartCredit.io introduces leveraged staking opportunities, providing users with the ability to 2x–5x their Lido staking positions under fixed conditions, complete with integrated free risk management tools to monitor loan and collateral health dynamically.

Security is central to SmartCredit.io. The platform has implemented an AI-based crypto fraud detection and transaction monitoring system — ChainAware.ai — which proactively assesses wallet behavior to flag potential fraud before transactions occur. This predictive analytics approach offers a 98% accuracy rate and ensures that both CeFi and DeFi users can participate with enhanced safety.

Competitors like Aave, Compound, and Maple Finance offer DeFi lending services; however, SmartCredit.io differentiates itself through its fixed-term loans, personal lending funds, efficient collateral usage, and AI-powered security infrastructure. Unlike traditional money market models that expose users to systemic risks, SmartCredit.io offers true isolation and individualized control.

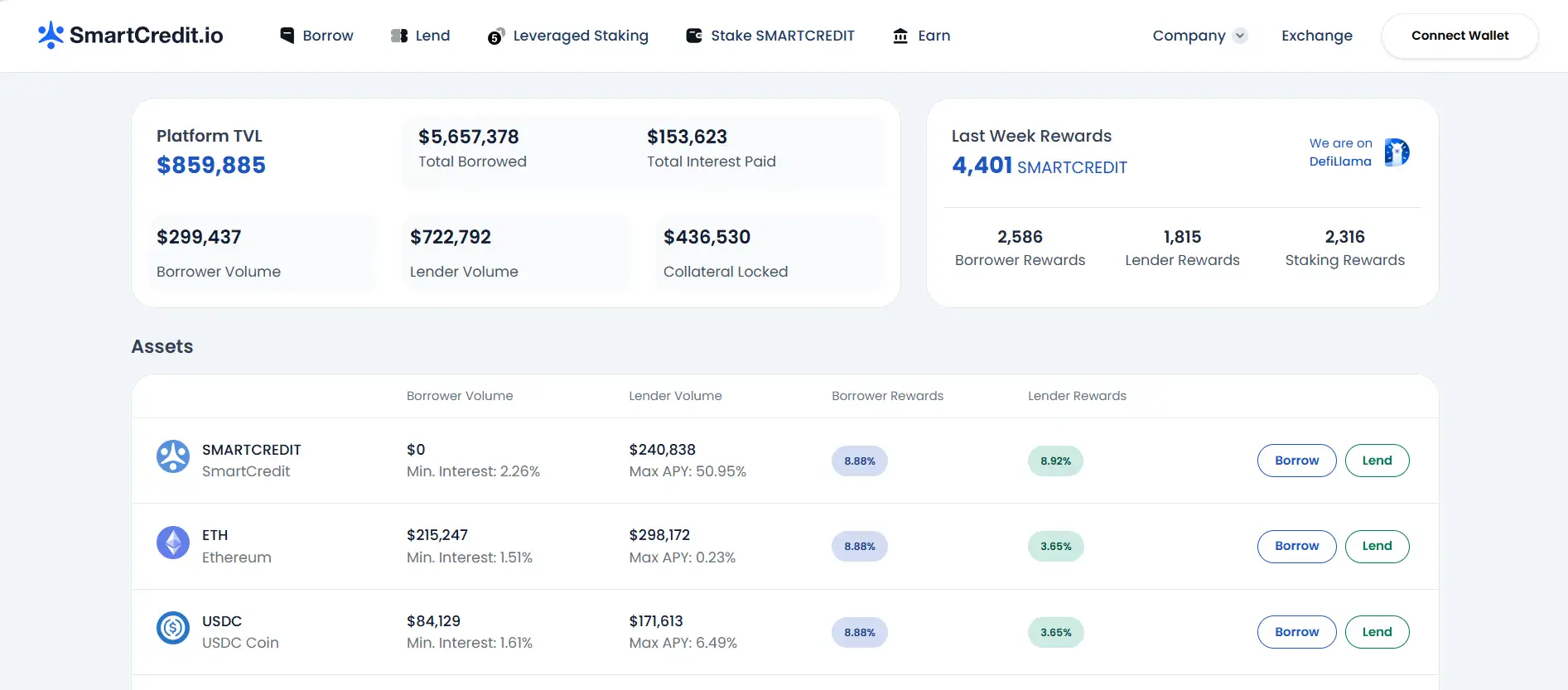

Furthermore, with over 20,000 registered users, a rapidly growing lending volume, and integrations into DeFi ecosystems like DefiLlama and Dune Analytics, SmartCredit.io continues to expand its role as the leading AI-enhanced self-custodial neobank for the blockchain future.

SmartCredit.io offers an extensive range of features and benefits for DeFi participants:

- Fixed-Term, Fixed-Interest Loans: Borrowers know their exact repayment obligations in advance.

- Personal Fixed Income Funds: Lenders customize portfolios and earning strategies according to their risk profiles.

- Leveraged Lido Staking: Boost Lido staking positions by up to 5x with integrated risk control.

- Gasless Restaking: Reinvest staking rewards automatically without paying gas fees.

- AI-Based Fraud Detection: Proactive predictive analytics prevent fraud at wallet connection level.

- Weekly Staking Rewards: Earn weekly rewards with yields up to 25% APY.

- Real-Time Position Monitoring: Telegram notifications help manage borrowing risks proactively.

- Open and Auditable: Transparent data access via DefiLlama and Dune Analytics.

Starting your journey with SmartCredit.io is simple and rewarding:

- Connect Wallet: Visit SmartCredit.io and click “Connect Wallet” to link your crypto wallet.

- Choose Your Action: Start lending, borrowing, staking SMARTCREDIT, or leveraging your staked assets.

- Create Loan or Lending Offers: Set terms for fixed-rate borrowing or build your personal lending fund.

- Monitor Your Positions: Enable real-time monitoring through Telegram notifications for optimal safety.

- Earn Rewards: Stake SMARTCREDIT tokens and restake automatically to maximize your returns.

- Use AI Security Tools: Benefit from ChainAware.ai real-time fraud detection technology.

SmartCredit.io FAQ

SmartCredit.io offers fixed-term and fixed-interest-rate loans, ensuring borrowers know their exact repayment amount from the start. This predictability shields users from the volatility of variable rates common in DeFi, providing a stable, transparent borrowing experience unmatched by traditional money market protocols.

Through Personal Fixed Income Funds, SmartCredit.io enables lenders to create customized lending strategies aligned with their risk tolerance. Lenders can define terms, choose preferred loan durations, and earn fixed yields, all while enjoying full non-custodial control of their assets and weekly rewards distribution.

The AI-based Crypto Transactions Monitoring by SmartCredit.io analyzes wallet interaction patterns in real-time through ChainAware.ai. This system detects potential fraud risks before transactions occur, ensuring that fraudulent wallets cannot participate, thus significantly enhancing platform security for all users.

SmartCredit.io introduces fixed-rate leveraged Lido staking with integrated risk management tools. Users can amplify their staking yields by 2x–5x while enjoying fixed interest and the ability to exit early via Curve pools, providing a safer, more predictable alternative to variable leveraged staking methods.

SmartCredit.io uses a dynamic Position Monitoring System that sends real-time Telegram notifications when liquidation risks rise. Borrowers can proactively manage their loans by adjusting collateral or repaying early, ensuring optimal collateral usage efficiency and reducing unnecessary liquidations, unlike traditional DeFi money markets.

You Might Also Like