About Tarot

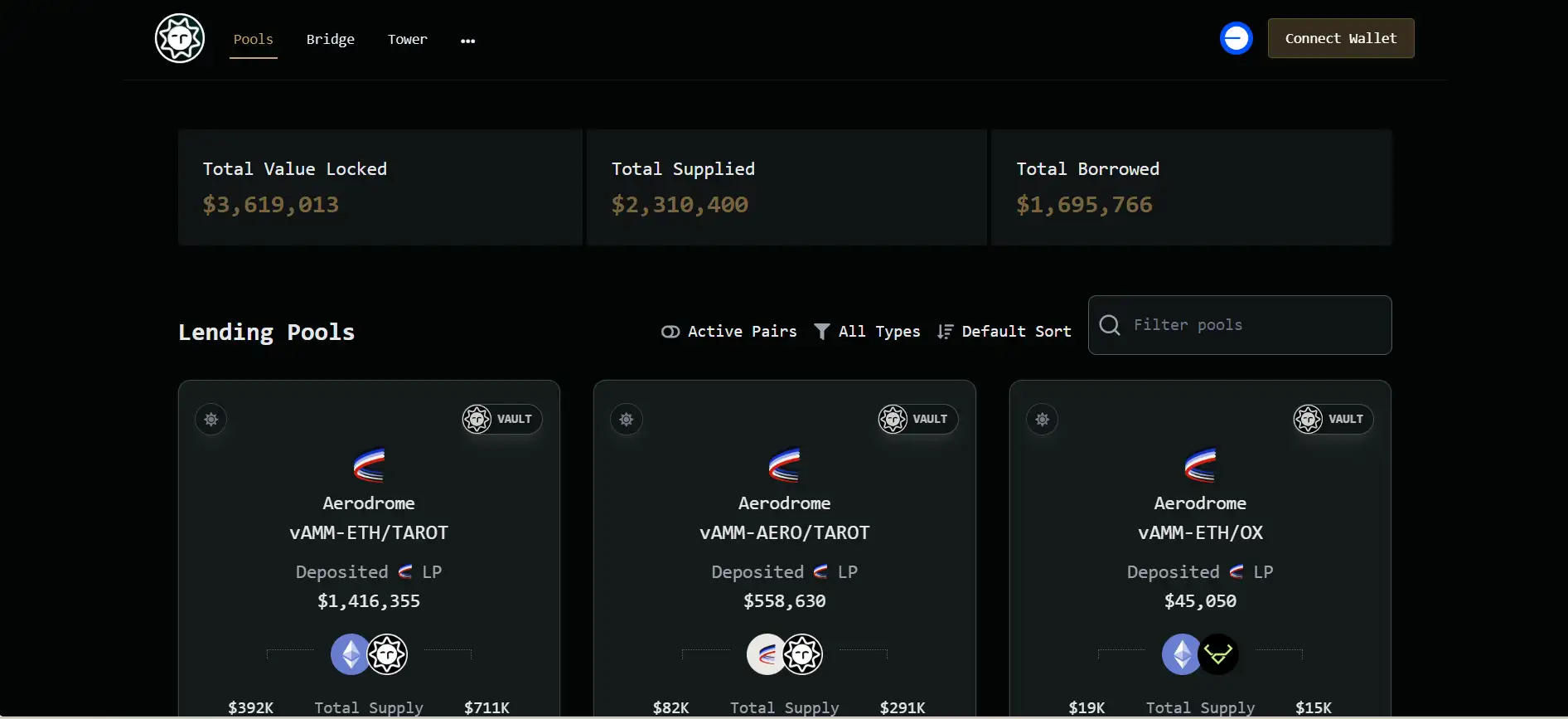

Tarot is a powerful and versatile multi-chain decentralized lending protocol that empowers users to either earn passive yield or participate in leveraged yield farming with LP tokens. Designed for flexibility and scalability, Tarot supports an extensive list of EVM-compatible networks, including Fantom, Arbitrum, Optimism, Base, zkSync Era, Polygon, and more, with plans to expand to Scroll and Monad.

What makes Tarot unique is its use of isolated lending pools, which ensure that risks are compartmentalized. Lenders can supply assets to specific pools and earn yield without facing impermanent loss, while borrowers can deposit LP tokens to unlock additional capital and engage in leveraged farming strategies. The protocol is permissionless, non-custodial, and designed for anyone to deploy and use lending markets securely.

Tarot began with a mission to introduce a more capital-efficient and user-friendly approach to decentralized lending. Unlike conventional DeFi protocols, Tarot operates on an isolated pool model, meaning each lending market is self-contained. This approach enhances security, minimizes risk contagion, and opens the door for highly customizable lending markets that can be tailored to specific LP token pairs across supported networks.

Tarot’s architecture consists of smart contracts categorized into core and periphery components. The core contracts include the Lending Pool Factory and Deployers that allow anyone to launch new pools. The periphery contracts enable user interactions such as supplying tokens, leveraging positions, or withdrawing collateral. All pools are linked to decentralized exchanges (DEXs) like SpiritSwap, and Aerodrome, providing deep integration with DeFi’s existing liquidity infrastructure.

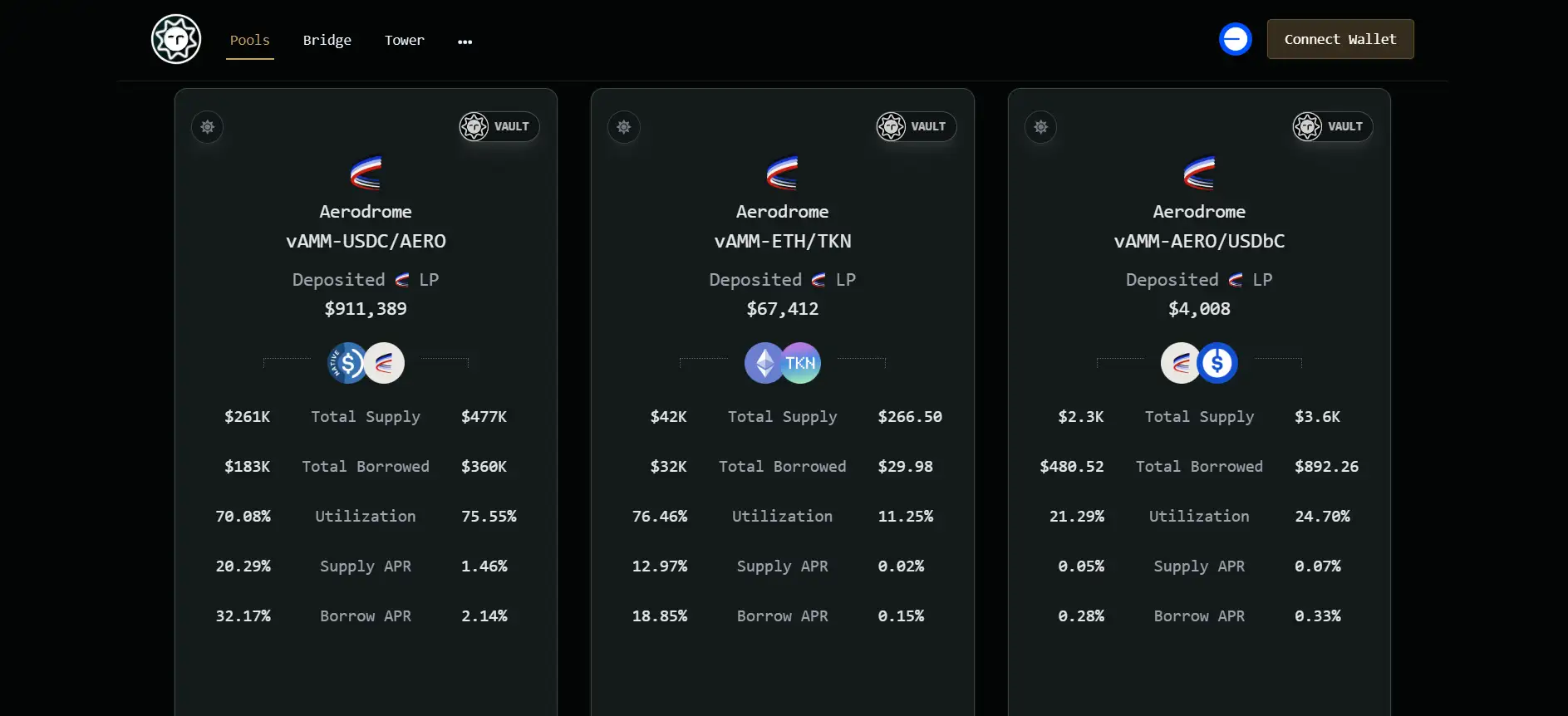

The protocol's lending model revolves around LP token collateralization. Borrowers deposit LP tokens to borrow either or both assets from the pair. This mechanism powers leveraged yield farming, allowing users to amplify returns from farming incentives, swap fees, and reinvested rewards. Lenders benefit from stable APRs without the downside of impermanent loss, while borrowers take on the strategic risk in exchange for potentially higher yields.

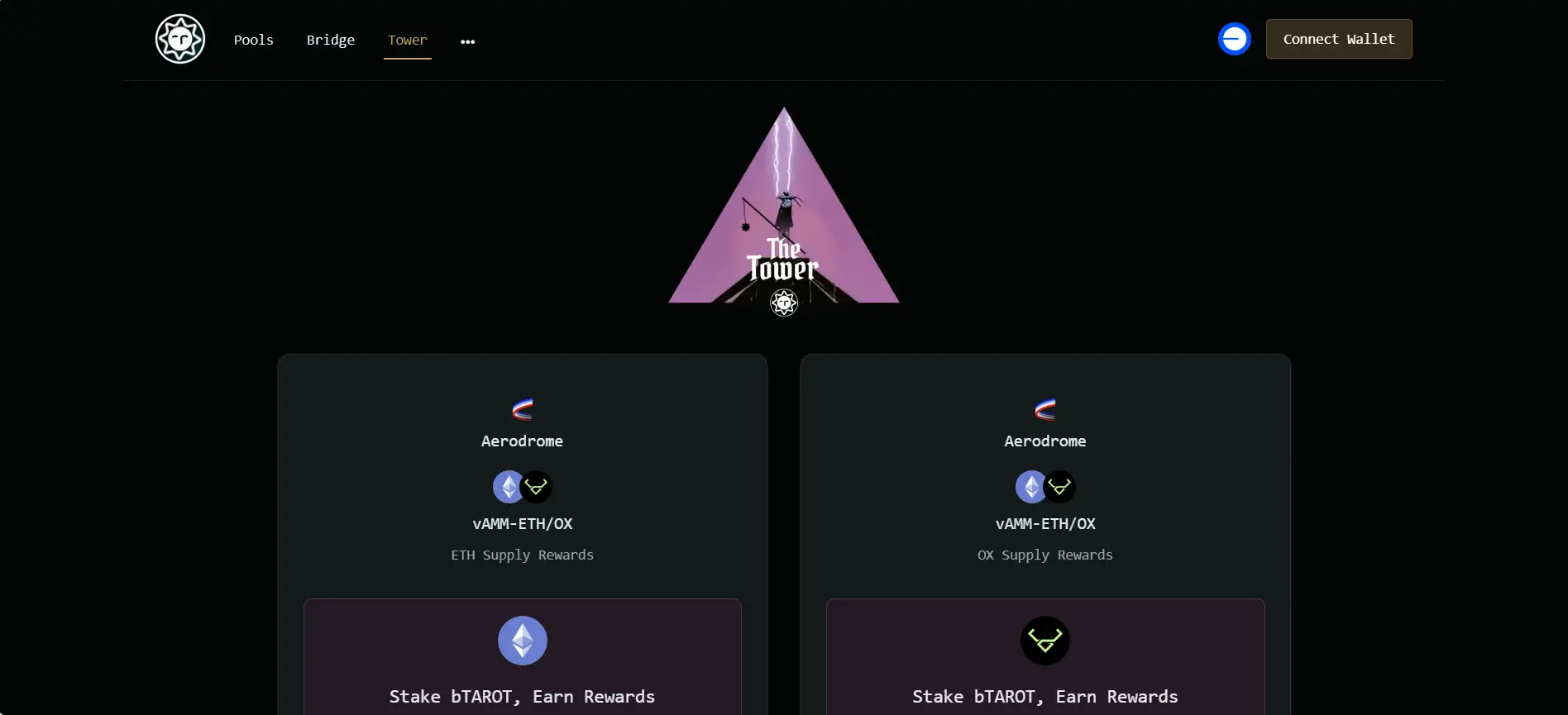

Another powerful aspect of Tarot is its Vault system, which automatically reinvests rewards to compound earnings. This system is governed by a permissionless bounty mechanism, allowing any user to trigger the reinvestment process in exchange for a small bounty. Additionally, auto-compounding vaults work seamlessly with Tarot’s integrated DEXs, enabling users to continually optimize their returns.

Competitively, Tarot distinguishes itself from projects like Aave, Compound, and Uniswap by focusing specifically on LP-based leveraged yield farming rather than general lending. Its focus on isolated pools makes it particularly resilient to systemic DeFi failures and black swan events, giving users greater confidence in capital preservation.

As Tarot evolves, future milestones include expanding governance through xTAROT staking, onboarding additional EVM-compatible chains, and refining interest rate models. This makes Tarot one of the most comprehensive, secure, and modular lending protocols in the DeFi space.

Tarot provides numerous benefits and features that make it a standout project in the DeFi lending and leveraged yield farming ecosystem:

- Multi-Chain Access: Deployed across Ethereum, Fantom, Optimism, Arbitrum, zkSync, and Base for widespread user access and capital mobility.

- Isolated Lending Pools: Each pool operates independently, limiting systemic risk and enabling customized strategies per token pair.

- Leveraged LP Strategies: Users can deposit LP tokens and borrow additional capital to scale yield farming returns significantly.

- Auto-Compounding Vaults: Reinvests farming rewards to maximize yield without manual intervention.

- Permissionless Deployment: Anyone can create new lending pools using Tarot’s factory contracts, fostering decentralized expansion.

- Dynamic Interest Rates: APRs for lending and borrowing adjust automatically based on pool utilization, improving capital efficiency.

- Staking and Governance: Stake xTAROT to earn protocol fees and influence strategic decisions through decentralized governance.

- No Impermanent Loss for Lenders: Lenders provide single assets and avoid LP volatility while earning stable interest.

Tarot offers a streamlined process for new users to start earning or farming within the decentralized finance (DeFi) ecosystem:

- Step 1: Navigate to the official platform at tarot.to and connect your wallet.

- Step 2: Choose a lending pool based on your preferred token or LP pair. You can filter pools by DEX or token symbol.

- Step 3: If you're a lender, supply your chosen token to the pool. If you're a borrower, deposit LP tokens to begin farming or borrowing.

- Step 4: Click Deposit, Leverage, or Borrow to open the corresponding dialog. Set your amounts using sliders or manually input values.

- Step 5: Approve the transaction in your wallet. Once approved, confirm the operation to interact with the protocol.

- Step 6: To withdraw, repay, or deleverage, follow similar steps in the Withdraw or Repay dialog sections.

- Step 7: For farming participants, claim your TAROT rewards directly from the Farm tab on each lending pool.

- Step 8: To join governance and earn protocol fees, stake TAROT for xTAROT via the xStaking interface.

Tarot FAQ

Leveraging across chains with Tarot allows you to open independent leveraged positions on each supported network like Fantom, Optimism, or Base, but positions remain isolated per chain, meaning you must manage APRs and liquidation risks separately on each instance of Tarot.

Yes, Tarot’s permissionless architecture allows anyone with a wallet and LP tokens to launch isolated lending pools without coding, directly via the Tarot interface using its smart contract factory system.

xTAROT staking gives you governance power and access to protocol fee distributions, while Vault staking focuses purely on maximizing LP-based auto-compounding yield within the Tarot farming system.

When utilization spikes, interest rates adjust automatically to discourage borrowing and attract more lenders, while the isolated pool structure ensures that only the specific pool is affected, protecting broader protocol stability on Tarot.

Because LP tokens are backed 50/50 by both assets in the pair, liquidation can occur from extreme movements in either direction; Tarot shows two prices to reflect these dual thresholds and give borrowers full clarity on their risk exposure.

You Might Also Like