About Timeswap

Timeswap is the first fully oracleless lending and borrowing protocol in DeFi, pioneering a new way to create permissionless, fixed-term, and non-liquidatable money markets for any ERC-20 token. Unlike conventional protocols that depend on price oracles and centralized governance, Timeswap enables any user to launch isolated pools, providing secure and predictable interest mechanics across tokens without relying on external feeds.

The project is designed with capital efficiency, decentralization, and risk isolation at its core. By removing the dependency on oracles, Timeswap offers lending and borrowing experiences immune to price feed manipulation. Every transaction is governed by a fixed maturity and a free-market-derived interest rate, delivering transparent and reliable outcomes for lenders, borrowers, and liquidity providers. With live deployments on Ethereum, Arbitrum, Polygon, Optimism, Base, Mantle, and HyperEVM, Timeswap is redefining lending in multi-chain DeFi.

Timeswap is a decentralized protocol for building oracle-free, fixed-term money markets for any fungible ERC-20 token. It eliminates liquidation risks and replaces interest rate oracles with free-market mechanisms embedded in a unique automated market maker (AMM). Built on the principles of simplicity and symmetry, Timeswap allows anyone to lend, borrow, or provide liquidity using any token pair and maturity date they prefer. Its isolated pools and game-theoretically sound mechanisms enable markets to self-correct without requiring governance interventions or emergency parameters.

The protocol was designed to overcome issues inherent in existing lending markets. Where others rely on centralized or semi-decentralized governance structures to manage interest rates and collateral risk, Timeswap uses its constant sum options model and a duration-weighted constant product AMM to ensure always-overcollateralized positions. This allows users to safely borrow assets without being subject to sudden liquidation or fluctuating interest rates. Borrowers can either repay their debts at maturity or walk away, forfeiting their collateral, which is then redistributed to lenders.

A defining innovation of Timeswap is its ability to support non-liquidatable loans, giving borrowers peace of mind while lenders enjoy guaranteed returns through fixed-term, market-driven APRs. Users can also exit early—with some slippage—before maturity. Lenders are issued ERC-1155 tokens that represent either the return in the borrowed asset or the borrower's collateral, depending on market conditions at maturity. Similarly, borrowers hold claim tokens and make decisions based on asset values at the end of term, rather than during volatile market fluctuations.

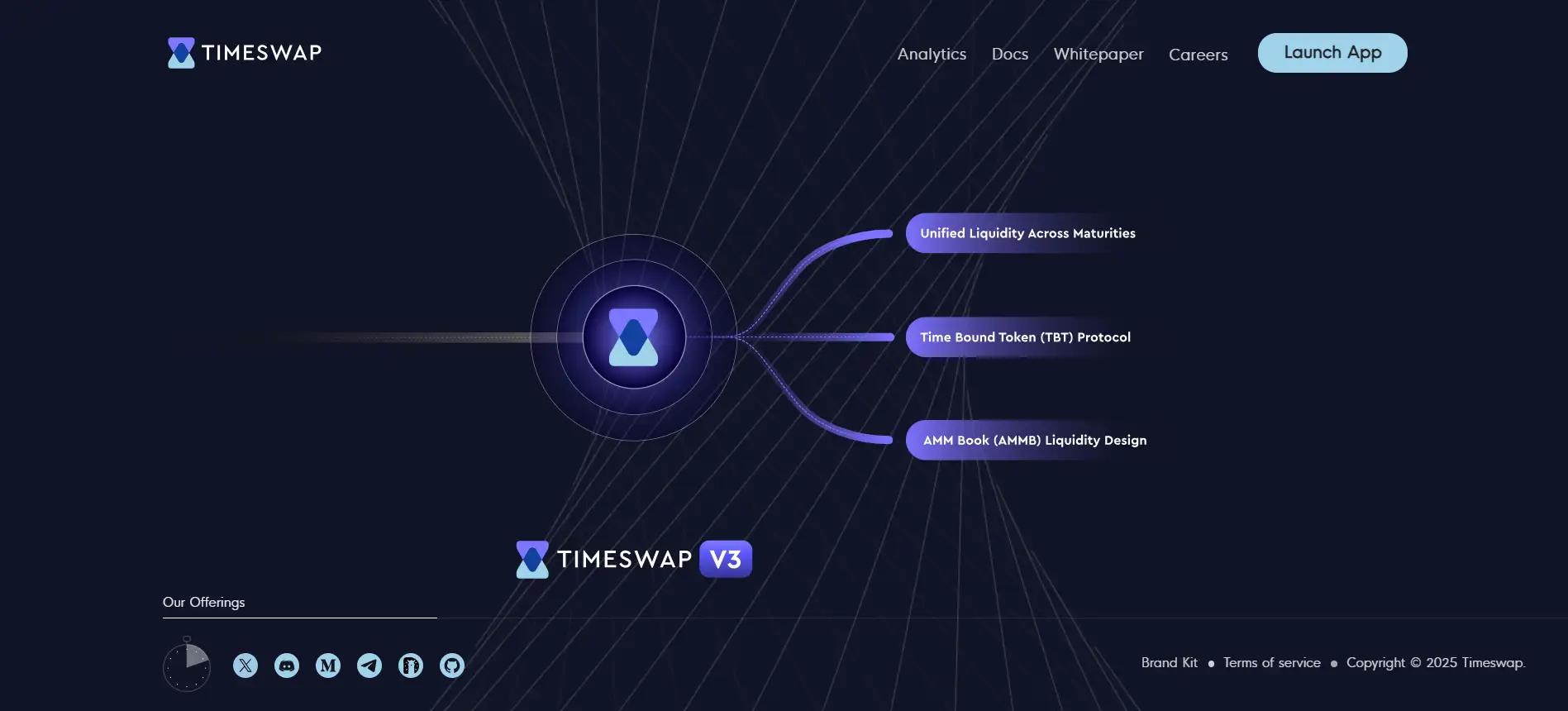

Developers can build on top of Timeswap to launch capital-efficient treasuries, perform debt-based fundraising (rather than equity sales), and enable lending for tokens with low on-chain liquidity. Use cases include yield swaps, capital-efficient hedging, token utility expansion for long-tail assets, and even decentralized token buybacks. The V2 upgrade introduces symmetric, bidirectional pools with improved gas efficiency and eliminates undercollateralized scenarios entirely. With liquidity live across major L2s and deep technical documentation, Timeswap is set to be a cornerstone primitive in DeFi’s evolution.

Comparable projects in the lending space include Aave, Compound, and Notional Finance. However, none of these match Timeswap’s oracleless, permissionless, and fixed-term architecture, giving it a unique competitive advantage in flexibility, capital efficiency, and market coverage.

Timeswap offers a variety of innovative features that make it a groundbreaking protocol in DeFi lending and borrowing:

- Oracleless Design: Eliminates external price feeds entirely, removing the risk of oracle manipulation attacks.

- Non-Liquidatable Loans: Users can borrow without worrying about mid-term liquidations. Decisions are only made at maturity.

- Fixed-Term Lending & Borrowing: Pre-defined interest and maturity ensure predictability for both parties.

- Permissionless Market Creation: Anyone can launch lending/borrowing pools for any ERC-20 pair by adding liquidity.

- Bidirectional & Isolated Pools: Supports lending and borrowing both ways for each token pair with no cross-risk between pools.

- Capital Efficient AMM: Uses a duration-weighted constant product formula to ensure optimal pricing and interest discovery.

- Tokenized Positions: Lending, borrowing, and LP positions are issued as ERC-1155 tokens, supporting composability and secondary trading.

Getting started with Timeswap is simple, transparent, and suitable for users of all experience levels. Here's how to begin:

- Visit the App: Go to Timeswap and connect your Web3 wallet.

- Choose Your Role: Select whether you want to lend, borrow, or provide liquidity. Each role has its own tokenized positions.

- Find a Pool: Choose from a list of existing pools or create a new one. Pools are defined by asset pair, strike price, and maturity.

- Lend or Borrow: Deposit assets to lend at a fixed rate, or lock collateral to borrow. All actions result in ERC-1155 tokens as proof of position.

- Manage Positions: Monitor your positions via the dashboard. You may exit early with slippage or wait until maturity.

- Earn as a Liquidity Provider: Add dual-sided liquidity to any pool and earn transaction fees from both borrowers and lenders.

- Stay Informed: Follow project updates and educational content on Twitter, Discord, and Medium.

Timeswap FAQ

Timeswap avoids using price oracles entirely by relying on its unique duration-weighted AMM, where all pricing, risk, and interest rates are determined by user interactions and arbitrage. This means that interest rates, collateral requirements, and pricing dynamics emerge directly from the market rather than external feeds. The model not only eliminates a major DeFi attack vector—oracle manipulation—but also enables instant market creation for any ERC-20 token pair. Learn more on Timeswap.

Timeswap is designed to support non-liquidatable loans. If a borrower doesn’t repay their position by maturity, their pre-locked collateral is forfeited to the lenders and liquidity providers. This mechanism ensures capital security for lenders without requiring active management or real-time liquidation. The system shifts all risk assessment to pool setup and user choice—empowering the market, not a centralized party, to enforce discipline. More details are on Timeswap.

Timeswap is fully permissionless, so anyone can launch a new pool by choosing a token pair, setting a strike (transition) price, and selecting a maturity date. There is no whitelist, governance vote, or oracle requirement. As long as there’s enough liquidity, the pool is live and ready. This makes Timeswap ideal for emerging tokens or DAO-native assets without deep oracle support. Start building pools on Timeswap.

The transition price (also called strike price) is a fixed threshold set at pool creation that determines how asset flow behaves at maturity. If the spot price of the borrowed asset stays above the transition price, borrowers are incentivized to repay and retrieve their collateral. If it falls below, it becomes rational to forfeit the collateral. This design creates clear, binary outcomes and ensures each pool maintains isolated and predictable risk profiles. Explore the concept further at Timeswap.

Yes, Timeswap supports early exits for lenders, borrowers, and liquidity providers. Although every position is defined by a fixed maturity, users can close or rebalance their exposure before expiry—typically through counter-transactions or market swaps. Early exits may involve slippage or reduced payout due to market conditions, but the protocol’s symmetric AMM design ensures fairness and availability. Dive deeper via Timeswap.

You Might Also Like