About VyFinance

VyFinance is a decentralized finance (DeFi) platform built on the Cardano blockchain, aimed at providing accessible and user-friendly financial products. The platform is designed to cater to both experienced DeFi users and newcomers by simplifying the complexities of decentralized finance and making it more accessible to a broader audience.

The mission of VyFinance is to empower users with innovative financial tools that allow them to participate in the DeFi space effortlessly. By leveraging the security, scalability, and efficiency of the Cardano blockchain, VyFinance aims to create a seamless and efficient ecosystem where users can trade, stake, and earn rewards.

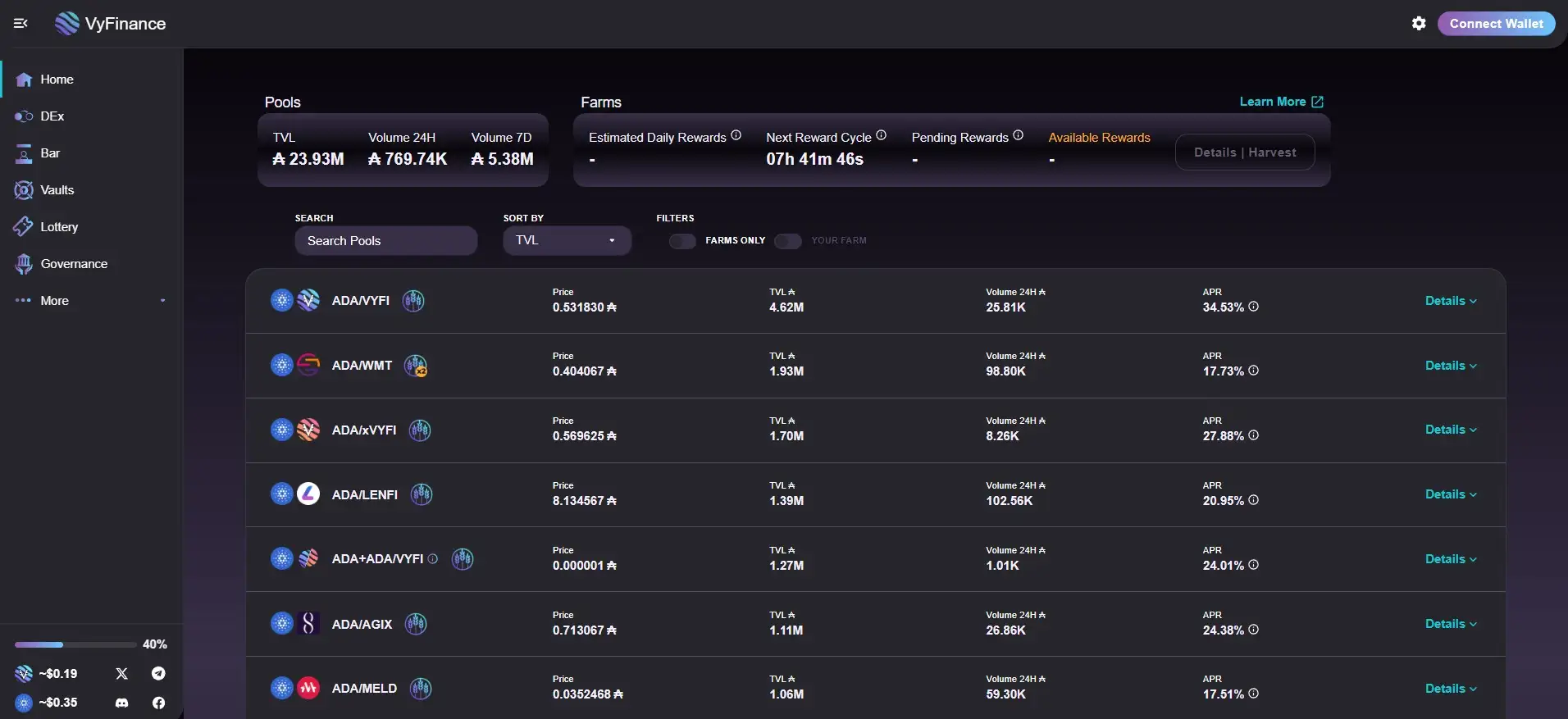

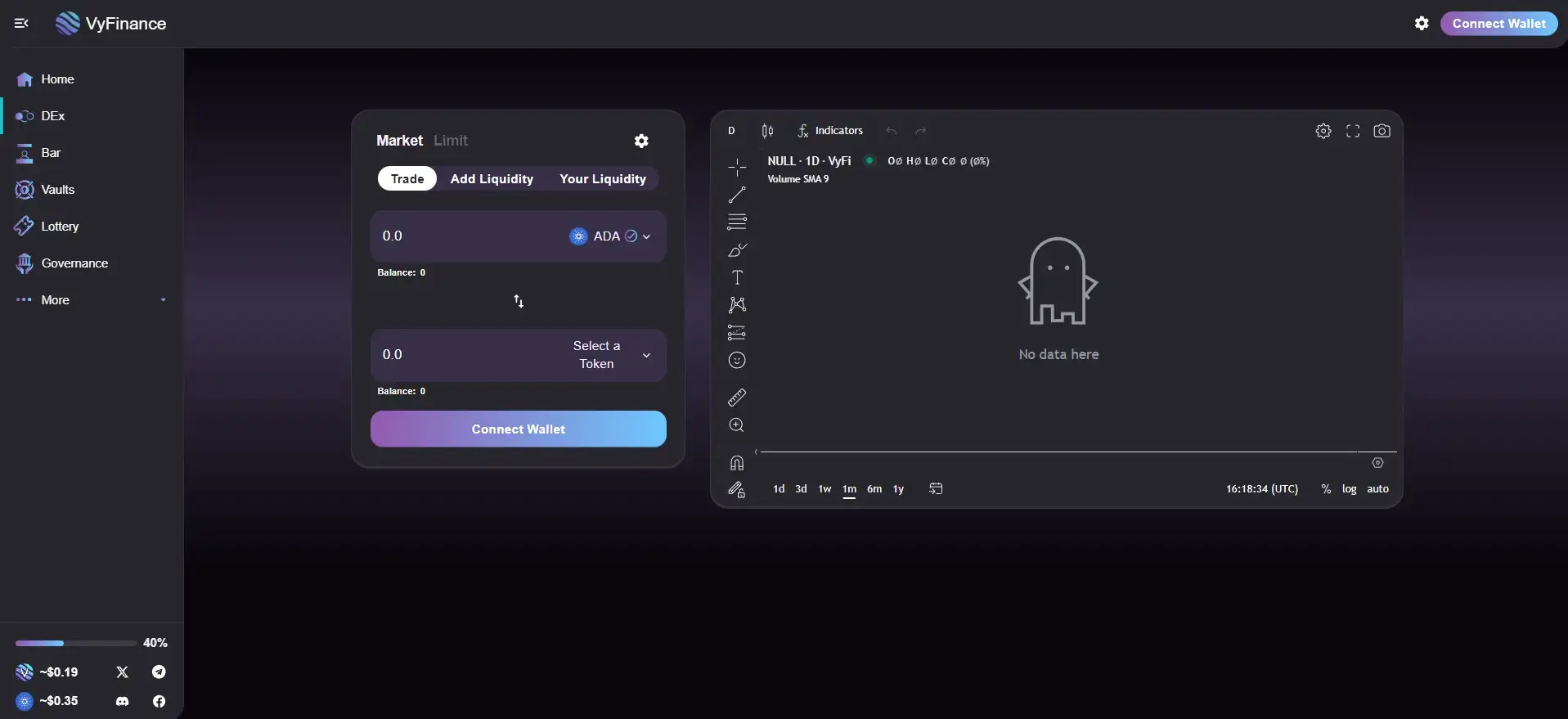

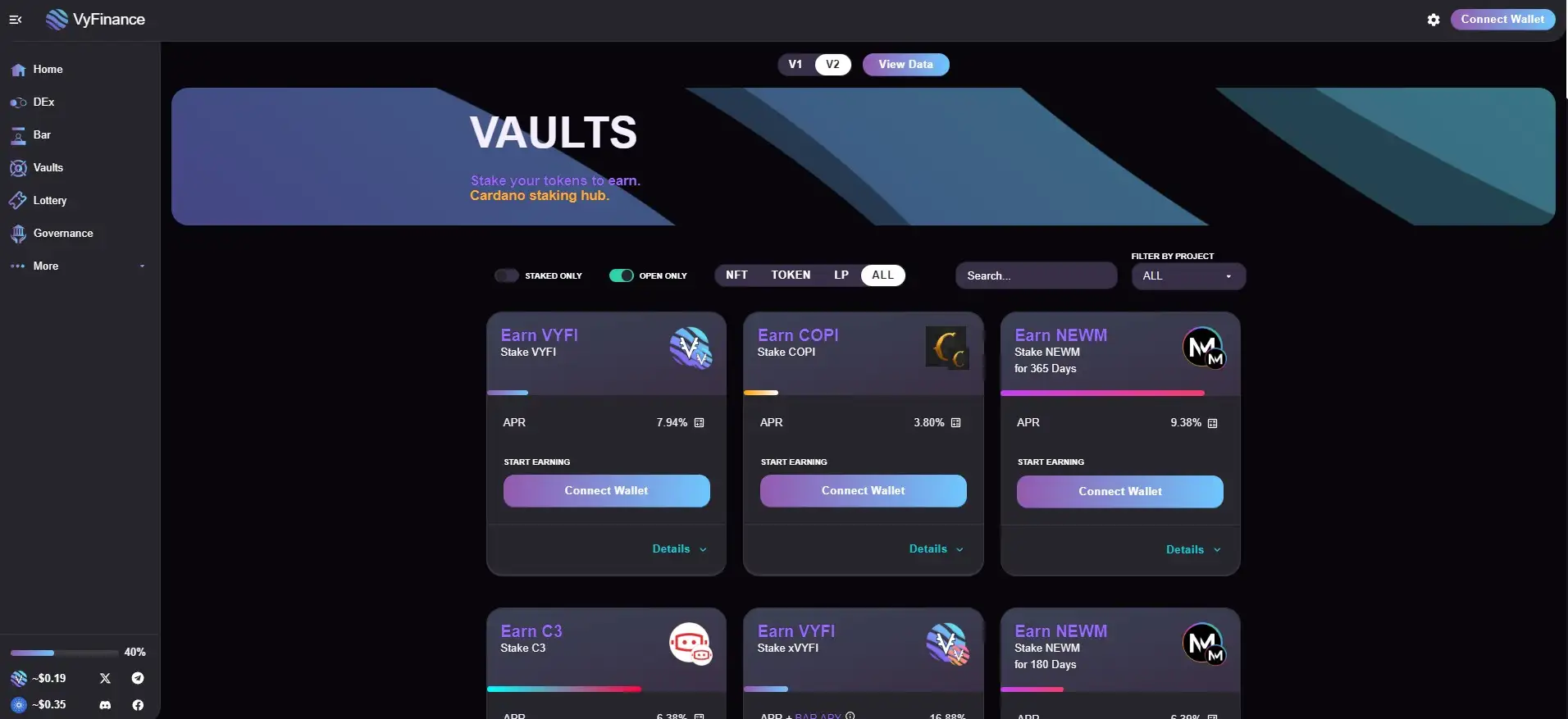

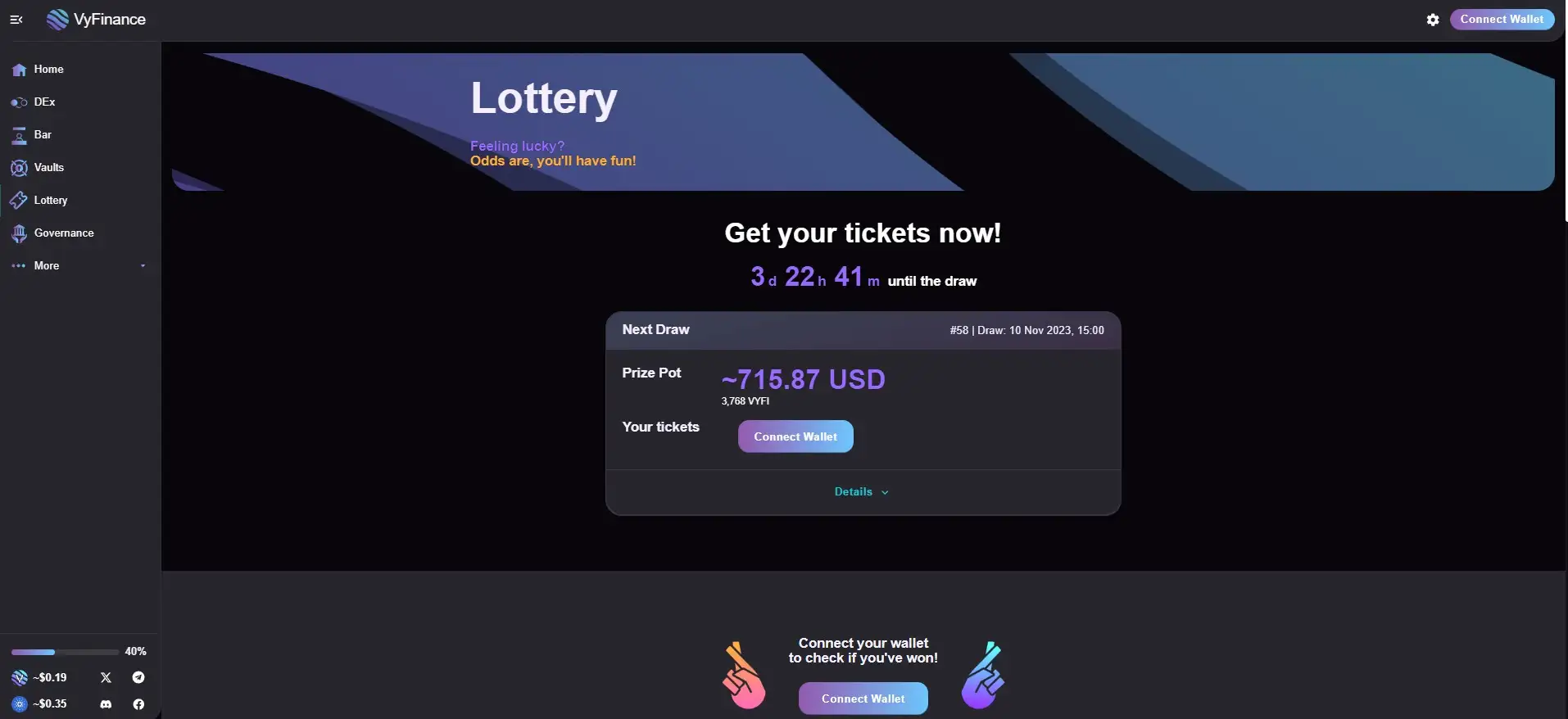

VyFinance offers a range of products and services, including a decentralized exchange (DEx), automated trading strategies, yield farming opportunities, and staking vaults. These features are designed to provide users with various ways to maximize their returns while minimizing risks. The platform's user-centric approach is evident in its focus on ease of use, transparency, and security.

VyFinance is a cutting-edge decentralized finance (DeFi) platform that operates on the Cardano blockchain. The project was developed to address the complexities and barriers to entry that many users face when interacting with DeFi platforms. By offering a user-friendly and intuitive interface, VyFinance aims to democratize access to decentralized financial services and make them accessible to a broader audience.

The development of VyFinance has been marked by several key milestones. The platform was founded with the vision of creating an all-in-one DeFi hub that integrates various financial products and services. Since its inception, VyFinance has focused on building a strong community and developing innovative features that differentiate it from other DeFi platforms on Cardano.

One of the key developments in the history of VyFinance is the launch of its Automated Market Maker (AMM) model. This AMM is designed to optimize liquidity provision and trading efficiency, making it easier for users to participate in the platform's decentralized exchange (DEx). The AMM is integrated with the VYFI token, allowing users to stake their tokens and earn rewards while providing liquidity to the platform.

Another significant milestone is the introduction of the BAR redistributive mechanism, which rewards long-term token holders based on the performance of the platform. This feature is unique to VyFinance and reflects the platform's commitment to creating a sustainable and rewarding ecosystem for its users.

VyFinance has also established itself as a key player in the Cardano DeFi space by integrating various decentralized applications (dApps) and collaborating with other projects within the Cardano ecosystem. This has allowed VyFinance to expand its offerings and provide users with a comprehensive suite of financial products.

Competitors of VyFinance in the Cardano DeFi space include platforms like SundaeSwap and MuesliSwap. These platforms also offer decentralized exchange services and liquidity provision on the Cardano blockchain. However, VyFinance differentiates itself through its unique features, such as the BAR redistributive mechanism and its focus on user-friendly, automated trading strategies.

As the DeFi space continues to evolve, VyFinance is committed to staying at the forefront of innovation. The platform's ongoing development efforts are focused on expanding its product offerings, improving user experience, and enhancing the security and scalability of its ecosystem. By doing so, VyFinance aims to create a robust and sustainable DeFi platform that meets the needs of a diverse user base.

VyFinance offers a variety of benefits and features that make it a standout in the Cardano DeFi ecosystem:

- User-Friendly Interface: VyFinance is designed with simplicity in mind, making it accessible for both new and experienced users in the DeFi space.

- Decentralized Governance: VYFI token holders can participate in governance decisions, ensuring that the community has a voice in the platform's future.

- Staking and Yield Farming: Users can stake their VYFI tokens in vaults to earn rewards, with options for both token and NFT staking.

- BAR Redistributive Mechanism: A unique feature that rewards long-term token holders based on the platform’s overall performance, creating a sustainable ecosystem.

- Automated Trading Strategies: VyFinance integrates automated trading strategies within its DEx, optimizing liquidity provision and trading efficiency.

- Liquidity Provision: Users can provide liquidity on VyFinance's decentralized exchange and earn a share of trading fees.

- Cardano Blockchain: Leveraging Cardano's scalability, security, and efficiency ensures a robust foundation for the platform.

Overall, VyFinance is a comprehensive DeFi platform offering multiple ways to earn, stake, and participate in the growing Cardano DeFi ecosystem.

Getting started with VyFinance is simple and straightforward:

- Create a Wallet: First, you'll need a Cardano-compatible wallet like Nami or Daedalus. Download and set up the wallet by following the instructions provided by the wallet provider.

- Fund Your Wallet: Purchase ADA (Cardano's native cryptocurrency) from an exchange like Binance or Coinbase, and send it to your Cardano wallet address.

- Access VyFinance: Visit VyFinance's official website and connect your Cardano wallet. Ensure your wallet is connected to the Cardano network.

- Explore Features: Once connected, you can explore VyFinance's features, such as the decentralized exchange, staking vaults, and automated trading strategies. Navigate through the platform to find the options that suit your needs.

- Stake and Earn: Choose a staking vault or liquidity pool, deposit your VYFI tokens or other supported tokens, and start earning rewards.

- Participate in Governance: As a VYFI token holder, you can participate in governance by voting on proposals that impact the platform’s future.

- Stay Informed: Follow VyFinance on their social media channels and join their community forums to stay updated on the latest developments and opportunities.

By following these steps, you can fully engage with the VyFinance platform and take advantage of its DeFi offerings.

VyFinance Token

VyFinance Reviews by Real Users

VyFinance FAQ

The BAR redistributive mechanism on VyFinance allows users to deposit their VYFI tokens into a vault, where they can earn rewards based on the platform's performance. Over time, rewards are redistributed among participants, providing a sustainable way to earn from long-term holding.

Yes, every VYFI token holder has the right to participate in governance on VyFinance, regardless of the number of tokens they hold. Governance decisions are typically weighted by the number of tokens, but all holders can vote on proposals.

VyFinance’s Automated Market Maker (AMM) is designed to optimize liquidity and trading efficiency. Unlike traditional AMMs, it integrates automated trading strategies that maximize returns for liquidity providers, making it a standout feature in the Cardano DeFi ecosystem.

Absolutely! VyFinance is built with a user-friendly interface designed to make DeFi accessible to everyone, including beginners. The platform provides simple tools and resources to help new users navigate the complexities of decentralized finance.

The NFT vaults on VyFinance allow users to stake NFTs along with tokens to earn rewards. This innovative feature blends traditional token staking with the growing popularity of NFTs, offering users a unique way to maximize their assets' value.

You Might Also Like