About World Liberty Financial

World Liberty Financial is a next-generation financial platform bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi). Its mission is to build an inclusive, transparent, and efficient financial ecosystem powered by modern blockchain infrastructure and accessible on-chain tools. World Liberty Financial combines stable digital assets, decentralized governance, and institutional-grade services to serve both individual users and global financial institutions.

From its flagship stablecoin USD1 to its governance and utility token $WLFI, the platform creates real-world utility by integrating with multiple blockchain networks and traditional financial systems. Through user-centric apps and protocol-level innovation, World Liberty Financial positions itself as a pivotal player in shaping the future of finance for all.

World Liberty Financial is a blockchain-based financial ecosystem developed to modernize how value is stored, transferred, and governed. The project centers around creating seamless interoperability between traditional banking systems and decentralized technologies. At its core are two primary offerings: $WLFI, a governance and utility token, and USD1, a fully backed, 1:1 redeemable stablecoin designed for digital transactions and capital markets.

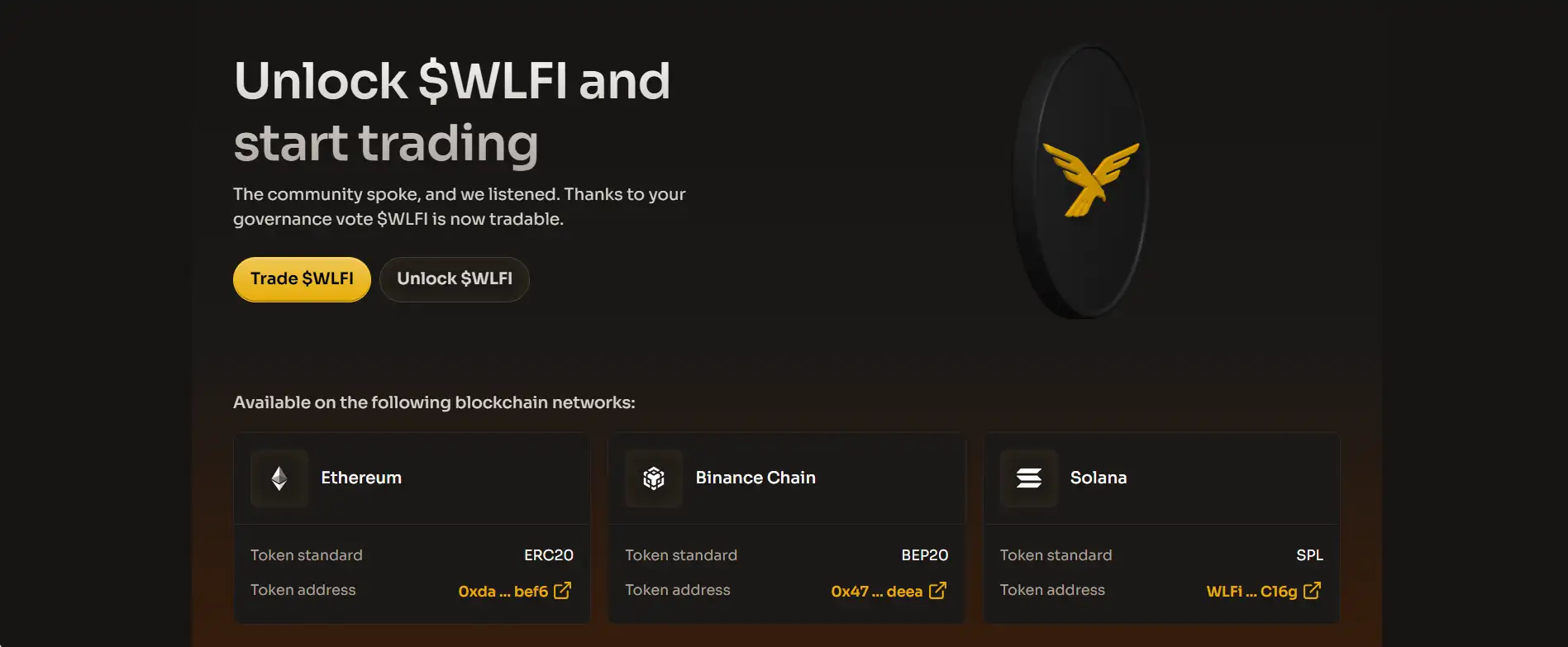

With $WLFI now tradable across Ethereum (ERC-20), Binance Smart Chain (BEP-20), and Solana (SPL), the project embraces a multi-chain approach that enables broad access and interoperability. It also features a cross-chain bridge powered by third-party integrations like Transporter.io, allowing users to move tokens between networks with ease. Governance is community-driven, empowering token holders to propose and vote on protocol changes, fees, and development roadmaps.

On the stablecoin side, USD1 is a digital dollar built for security, scale, and simplicity. Backed by U.S. cash and government money market funds, it is designed to serve both institutional and retail needs. The asset is fully transparent, with monthly attestation reports and full fiat redemption options for verified users. Supported across Ethereum, BNB Chain, Solana, Tron, and Plume, USD1 is optimized for fast, cheap, and 24/7 settlement.

The platform's long-term mission is to democratize access to capital and financial tools. That means building products for everyday users and large institutions alike—whether it’s offering loans, global stablecoin payments, or secure crypto wallets connected to real-world banking. World Liberty Financial aims to simplify DeFi and open new pathways for people to engage with the digital economy on their own terms.

World Liberty Financial has also attracted notable attention due to the public affiliations of its backers. Entities connected to Donald J. Trump and his family hold indirect ownership stakes and token allocations, although these connections are not endorsements. The platform itself makes clear that its products, including $WLFI and USD1, are non-political and operate independently within the broader DeFi landscape.

By combining a multi-chain stablecoin, decentralized governance, and real-world banking integrations, World Liberty Financial is positioning itself as a bridge between legacy systems and the emerging open economy. Similar projects in this space include Circle (USDC), Tether (USDT), and Sky (DAI), but WLFI's governance and ecosystem structure offer a unique institutional twist.

World Liberty Financial offers a wide range of benefits and features that serve users across the DeFi and TradFi spectrum:

- USD1 Stablecoin: Fully backed 1:1 with U.S. dollars and money market funds, USD1 offers transparent, stable, and multi-chain value storage.

- $WLFI Token: The governance and utility token that powers voting, access to features, and protocol upgrades across the World Liberty ecosystem.

- Multi-Chain Support: Both $WLFI and USD1 are live across Ethereum, BNB Chain, Solana, Tron, and more—making them broadly accessible.

- Bridge Capabilities: Secure token movement between chains using third-party services such as Transporter.io and Chainlink CCIP.

- Community Governance: $WLFI holders vote on key decisions through a decentralized governance system.

- Bank Integrations: The upcoming WLFI App will allow users to deposit via wallet or bank account and manage liquidity.

- Lend & Borrow (Coming Soon): Decentralized lending and borrowing with real-time risk monitoring and capital efficiency.

- Real-World Adoption: Focused on bridging DeFi to mainstream institutions, governments, and fintech platforms.

World Liberty Financial makes it easy to start using its products and engaging in its on-chain financial ecosystem:

- Visit the Website: Head to the official site to explore the full suite of tools, tokens, and integrations.

- Trade $WLFI: Acquire the token on supported networks including Ethereum (ERC20), BNB Chain (BEP20), and Solana (SPL).

- Bridge Assets: Use integrated bridges like Transporter.io or Chainlink CCIP to move $WLFI or USD1 between blockchains.

- Get USD1: Purchase USD1 from major exchanges such as Binance, ByBit, Gate.io, Bitget, and swap it easily on platforms like Uniswap or PancakeSwap.

- Govern the Protocol: Participate in governance via the $WLFI governance portal.

- Prepare for App Launch: Get ready for the WLFI App and lending platform, which will support wallet and bank integration for everyday users.

- Follow Community Channels: Stay up to date via Twitter/X.

World Liberty Financial FAQ

$WLFI is not just a governance token; it represents an entire shift in how decentralized finance (DeFi) can integrate with legacy financial systems. While many governance tokens only offer protocol voting, $WLFI is tied directly to a multi-chain stablecoin (USD1), DeFi lending products, and upcoming institutional-grade applications. It serves as a bridge between on-chain governance and off-chain decision-making processes. Through community-driven proposals, token holders actively shape everything from fee structures to protocol expansion. Learn more at worldlibertyfinancial.com.

USD1 is a fully backed stablecoin that maintains a 1:1 peg with the U.S. dollar and is supported by U.S. cash and government money market funds. Unlike centralized stablecoins, USD1 prioritizes transparency through monthly reserve attestations and real-world liquidity options. It is available on multiple blockchains including Ethereum, BNB Chain, Solana, Tron, and Plume, and can be bridged securely using trusted services. This makes it one of the most flexible and secure digital dollar assets available today. Visit worldlibertyfinancial.com to get started.

Yes. The upcoming WLFI App is designed to support both crypto wallets and traditional bank accounts, making it one of the few DeFi apps focused on Web2-Web3 integration. Users will be able to deposit funds directly from their bank and access features like stablecoin conversion, yield earning, and spending tools—all while staying in control of their assets. This approach brings the familiar experience of banking into a decentralized financial world. Stay tuned on worldlibertyfinancial.com for the official app launch.

No. While entities connected to Donald J. Trump and family have economic interests through equity and token ownership, World Liberty Financial is not political in nature and does not represent or endorse any political campaign. The team has clarified that $WLFI and the WLF protocol are developed and governed independently, with open participation from a global community. Governance decisions are made through the WLFI token holder voting system. Visit worldlibertyfinancial.com to learn more about their governance policies.

USD1 is fully redeemable 1:1 for U.S. dollars through verified channels. Redemption is handled by BitGo, a regulated trust company, and is subject to KYC requirements. If you acquired USD1 through a secondary market, you’ll need to complete onboarding through BitGo before redeeming. This structure ensures compliance and maintains the asset’s stability. To begin the redemption process, visit worldlibertyfinancial.com and review the redemption terms under USD1 Risk Disclosures.

You Might Also Like